Dec 14, 2023However, most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act (TCJA) that Congress signed into law on December 22, 2017. The job-related expenses deduction is still available to people who work in one of these specific professions or situations:

Supreme Court Case About Construction Impact Fees Could Upend Housing Market in California – Times of San Diego

Californians who belong to a labor union are eligible for a new tax credit for their dues and businesses that received Paycheck Protection Program loans in 2021 won’t owe tax on forgiven amounts under a bill signed by Gov. Gavin Newsom (D) Thursday. Newsom signed the bill ( A.B. 158) as part of a 13-bill package lawmakers sent him on Aug. 29

Source Image: northstarmeetingsgroup.com

Download Image

Feb 11, 2023You can claim union dues as an unreimbursed business expense on your California return. Union dues are no longer deductible on your federal return. However, if you enter the amount in Deductions & Credits, TurboTax will move it to California. Type union dues in Search (magnifying glass) in the top right corner; Select Jump to union dues

Source Image: floretflowers.com

Download Image

Tesla battles with union organizers, Zoox hits the road and Zeekr scores more capital | TechCrunch Research of California legislation found no legislation that would have established an “above-the-line” deduction for union dues similar to this bill. Other States’ Information Florida, Illinois, Massachusetts, Michigan, Minnesota, and New York laws do not provide an “above-the-line” deduction comparable to the deduction this bill would allow.

Source Image: blog.steeswalker.com

Download Image

Can You Write Off Union Dues In California

Research of California legislation found no legislation that would have established an “above-the-line” deduction for union dues similar to this bill. Other States’ Information Florida, Illinois, Massachusetts, Michigan, Minnesota, and New York laws do not provide an “above-the-line” deduction comparable to the deduction this bill would allow. Sep 14, 2022California union members could receive tax credits to reimburse a portion of their dues payments under a bill awaiting Gov. Gavin Newsom’s signature. Assembly Bill 158, approved by the

Breaking Up Is Hard to Do: Ending Your California Residency – Stees, Walker & Company, LLP Blog

No, employees can’t take a union dues deduction on their return. Prior to 2018, an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business expenses, if the total of the dues plus certain miscellaneous itemized expenses reached a certain level. How to Plan a Wedding

:max_bytes(150000):strip_icc()/wedding-planning-ultimate-guide-recirc-Janet-Lin-Photography-f3d7c8f9fe854f69ada0fc53e6d100bd.jpg)

Source Image: brides.com

Download Image

Wedding Officiant Cost by Type, According to Real Couples No, employees can’t take a union dues deduction on their return. Prior to 2018, an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business expenses, if the total of the dues plus certain miscellaneous itemized expenses reached a certain level.

Source Image: theknot.com

Download Image

Supreme Court Case About Construction Impact Fees Could Upend Housing Market in California – Times of San Diego Dec 14, 2023However, most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act (TCJA) that Congress signed into law on December 22, 2017. The job-related expenses deduction is still available to people who work in one of these specific professions or situations:

Source Image: timesofsandiego.com

Download Image

Tesla battles with union organizers, Zoox hits the road and Zeekr scores more capital | TechCrunch Feb 11, 2023You can claim union dues as an unreimbursed business expense on your California return. Union dues are no longer deductible on your federal return. However, if you enter the amount in Deductions & Credits, TurboTax will move it to California. Type union dues in Search (magnifying glass) in the top right corner; Select Jump to union dues

Source Image: techcrunch.com

Download Image

Are Union Dues Tax-Deductible? Rules, Exceptions & Tips for Saving Jul 8, 2022A California bill related to the state’s 2022-2023 budget includes a proposed tax credit for union dues. Once implemented, the tax credit would be the first of its kind in the U.S. Union dues are currently tax-deductible in California and some other states. (A tax deduction lowers a person’s taxable income before calculating taxes, while a

Source Image: keepertax.com

Download Image

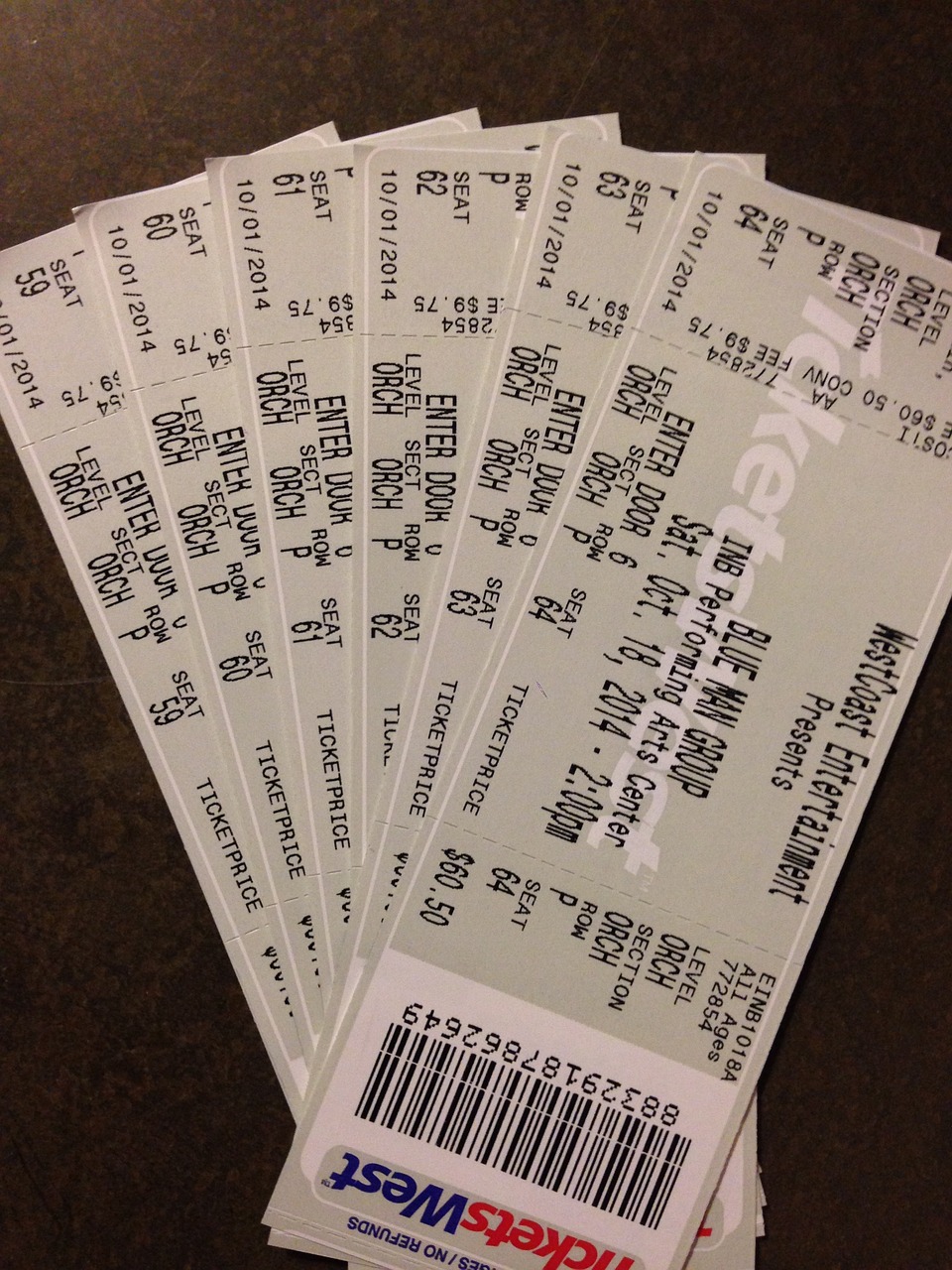

New California Law Bans ‘Junk Fees’ on Hotel Bills, Concert Tickets, and More – CPA Practice Advisor Research of California legislation found no legislation that would have established an “above-the-line” deduction for union dues similar to this bill. Other States’ Information Florida, Illinois, Massachusetts, Michigan, Minnesota, and New York laws do not provide an “above-the-line” deduction comparable to the deduction this bill would allow.

Source Image: cpapracticeadvisor.com

Download Image

Assembly Approves Sen. Dodd’s ‘Junk Fees’ Bill Sep 14, 2022California union members could receive tax credits to reimburse a portion of their dues payments under a bill awaiting Gov. Gavin Newsom’s signature. Assembly Bill 158, approved by the

Source Image: contracosta.news

Download Image

Wedding Officiant Cost by Type, According to Real Couples

Assembly Approves Sen. Dodd’s ‘Junk Fees’ Bill Californians who belong to a labor union are eligible for a new tax credit for their dues and businesses that received Paycheck Protection Program loans in 2021 won’t owe tax on forgiven amounts under a bill signed by Gov. Gavin Newsom (D) Thursday. Newsom signed the bill ( A.B. 158) as part of a 13-bill package lawmakers sent him on Aug. 29

Tesla battles with union organizers, Zoox hits the road and Zeekr scores more capital | TechCrunch New California Law Bans ‘Junk Fees’ on Hotel Bills, Concert Tickets, and More – CPA Practice Advisor Jul 8, 2022A California bill related to the state’s 2022-2023 budget includes a proposed tax credit for union dues. Once implemented, the tax credit would be the first of its kind in the U.S. Union dues are currently tax-deductible in California and some other states. (A tax deduction lowers a person’s taxable income before calculating taxes, while a